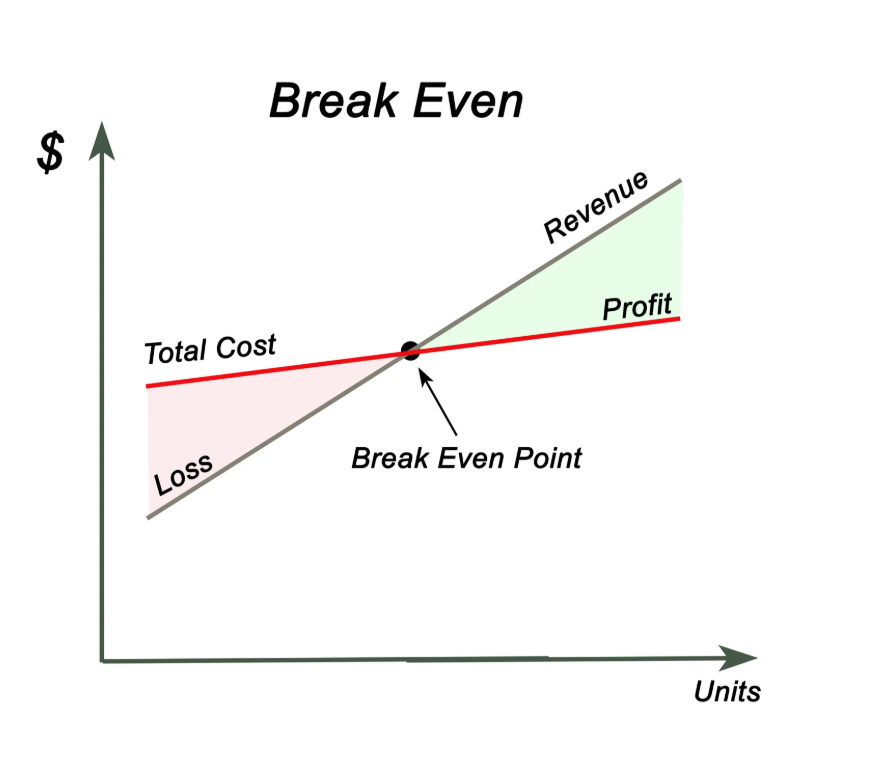

Starting a franchise in Canada offers a potentially lower-risk path to business ownership, but financial planning remains critical to success. One of the most important steps in assessing the viability of your investment is understanding your break-even point. This is the stage where your revenue equals your expenses — no profits yet, but no losses either. Calculating your break-even point not only helps in securing financing and setting realistic goals, but also gives you a clear sense of how long it will take before your franchise becomes profitable.

Understanding Fixed and Variable Costs

To accurately calculate your break-even point, it’s essential to understand the difference between fixed and variable costs. Fixed costs are expenses that do not change, regardless of how much business you do. These include your monthly rent, franchise fees, insurance, and certain utilities. In Canada, these costs can vary significantly by region, with urban centres like Toronto or Vancouver often commanding higher commercial lease rates.

Variable costs, on the other hand, change depending on your sales volume. These might include inventory, supplies, packaging, and labour costs tied to customer demand. For example, in a fast-food franchise, the cost of ingredients and part-time staffing will scale depending on how many meals are sold.

The Break-Even Formula

Once you’ve identified your fixed and variable costs, you can use a simple formula to calculate your break-even point in units:

Break-Even Point (Units) = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

This formula shows how many products or services you need to sell to cover all your costs. For service-based franchises, you can substitute “units” with hours or transactions. Understanding this number helps you set performance targets and pricing strategies that are grounded in financial reality.

Let’s say you’re running a coffee franchise in Ontario. Your fixed monthly costs (rent, salaries, franchise royalty fees, etc.) total $10,000. Each cup of coffee sells for $5, and the cost to produce one cup (beans, cup, milk, labour) is $2. According to the formula:

$10,000 ÷ ($5 – $2) = 3,333 cups

You would need to sell 3,333 cups per month to break even.

Factoring in Canadian Taxes and Royalties

Canadian franchisees must also account for taxes such as GST/HST, provincial tax variations, and franchise royalty fees, which are often a percentage of gross sales. These can affect your break-even point significantly. While the formula above provides a solid baseline, incorporating these additional expenses will give you a more accurate picture of the actual threshold for profitability. Be sure to consult a Canadian accountant or franchise consultant who understands the specific regional tax requirements.

Adjusting for Seasonality and Location

Another factor that can influence your break-even point is seasonality. Many franchises in Canada, such as those in tourism or landscaping, experience major fluctuations between summer and winter months. Your break-even analysis should account for slower periods and ensure you have enough financial cushion to cover costs year-round.

Location also plays a major role. High foot traffic areas may have higher rental costs, but also bring in more customers, potentially helping you reach your break-even point faster. On the other hand, a lower-cost suburban location might reduce your fixed expenses but require a more aggressive marketing strategy to generate sufficient sales.

Planning for Profitability

Calculating your break-even point is not just a one-time exercise — it’s a vital tool for ongoing business management. For Canadian franchisees, it helps shape key decisions, from pricing to marketing to staffing levels. By understanding exactly how much you need to sell in order to cover your expenses, you can operate your franchise with greater clarity and confidence. This foundational knowledge sets the stage for long-term profitability and resilience in a competitive market.